—>

Click to FB Fans Page to get more on Shanghai Company-setup Payroll Tax Accounting

Email: dxb2cn.east@evershinecpa.com

Or

Call to Kerry Chen well English Speaker

+86-184-103-1763

In Shanghai City, we provide services including company registration, online accountant using cloud web-system, payroll compliance and other services.

Service Coverage

*Company Registration

*Food Special Industry Permission

*Internet Service Provider- Let your web-station registered in China

*E-commerce opratiopn Certifucate Appication

*Trademark Registration

*Work Permit Application

*China Z-Visa Application

*Work Certificate Application

*Residence Permit Application

Evershine CPAs Firm Service Features

Staff speaking in English & Chinese. International tax planning assistance by Taiwan headquarters with English, Japanese, Indonesian & Malaysian speakers.

How to identify what kind of entity to register in Shanghai?

| With Tax ID? | Issues Sales Invoices? | Legal Entity? | Wholly owned by a Foreigner? | |

| Representative office | Yes | No | No | Yes |

| Branch | Yes | Yes | No | Yes** |

| Subsidiary | Yes | Yes | Yes | Yes |

| Joint Venture | Yes | Yes | Yes | No |

**Indirectly owned by Shanghai WFOE.

1) Representative Office

1.1 Expenditure payment to company’s vendors and employees

1.2 Payroll compliance issues handling

1.3 No need to issue local invoices in your representative office

1.4 The sale is directed to the parent company

2) Consulting WFOE

2.1 It is a legal entity and independent domestic company

2.2 Some cities can only issue General Sales Invoice, not VAT Sales Invoice

2.3 Minimum Capital is RMB 100,000 to 300,000

3) Trading WFOE

3.1 It is a legal entity and independent domestic company

3.2 General and VAT Sales Invoices issuance, expense payments and inventory purchasing

3.3 Minimum Capital is RMB 500,000 to 1,000,000

3.4 Needs approval from 9 government agencies

4) Manufacturing WFOE

4.1 It is a legal entity and independent domestic company

4.2 Issues General and VAT Sales Invoices

4.3 Minimum Capital depends on company’s business plan

4.4 Needs approval from 11 government agencies

5) Branch owned by China WFOE

(After setting up China WFOE, you can set up branch everywhere in China)

5.1 Direct issuance of sales invoice to the client by your branch

5.2 Payment of expenditures and inventory purchasing

5.3 Not a legal entity; all of its behavior is on behalf of your China WFOE

Shanghai WFOE Online Accountant Services

After completing WFOE Registration, we provide Trust-EnhanserR 4 in 1 services:

*Accounting and Tax Compliance

*Payroll Compliance

*Cloud Accounting System Platform

We provide Trust-EnhanserR 4 in 1 services for these enterprises (abbreviated as WFOE) in China. We undertake four functions including Accounting & Tax, Finance & Payroll Compliance, and Cloud System Provision. WFOE stands for Wholly Foreign Owned Enterprises.

We will act as your in-house accountant using web-platform system to create a collaborative working environment. Evershine staff don’t need to sit in your office but act as your accountants.

No need for you to fill your Accounting, Finance, Payroll and IT Departments in your WFOE in China.Fraud-proof, Seamless collaboration, Hassle-free are some of our service features.

Your company’s CFO or any assignee can approve payment request/s and do the money transfer through online banking anytime, anywhere!

As Evershine’s Standard Operating Procedure (SOP), we issue monthly reports within seven (7) days in compliance with IFRS.

We use a web-platform in servicing our clients belonging to our spin-off company, Evershine BPO Service Corp.

Our service also includes:

Payroll Cycle — Leave Application, Shifting Schedule, Payroll Calculation, Insurance, Pension Fund, Pay Slip Provision

Expenditure Cycle — Expenses: Employee, Office & Travel

Receiving Cycle — From Order to Cash

Payment Cycle — Purchases to Payment

General Ledger — Records to Report

VAT Filing

Cost Accounting

Shanghai Payroll Compliance dxb2cn.east Service

Our Service Coverage

* Company Registration of Shanghai WFOE (Wholly Foreign Owned Entity)

* Work Permit application in Shanghai

* Working Visa Application in Shanghai

* Local Services for expatriates like airport pick-up, hotel and renting, bank account etc,.

* Online Payroll Management System

* File for listing and delisting of Social Insurance and Housing Fund

* Gross salary calculation based on fixed and non-fixed salary, Leave and Overtime

* Social Insurance Charge paid by the company and employee

* Housing Fund Charge paid by the company and employee

* Withholding Tax

* Gross salary and net-cash salary

* Salary wire transferring services

* Delivering payment slip to each employee

* Accepting query from each employee.

* Monthly withholding tax report to Tax Bureau.

* Severance pay application

Our Online Payroll Management System includes the following modules:

* Online Basic Data collection

* Online Payroll Parameter collection

* Online Leave authorization

* Online Overtime authorization

* Online Payroll Calculation

* Online Proposal authorization

* Online Pay slip

* Custom tailor made if necessary

* Salary wire transferring services through local web banking function authorized by three roles including “Maker”, “Reviewer” & “Approver”. Evershine staff will play “Maker” role.

Payroll Compliance Regulations in Shanghai:

1. Once an employee is on board, he/she needs to apply for Social Insurance on the 1st day. If an employee wishes to leave the company, he/she must file her removal from social insurance.

2. Payroll for each employee includes taxable salary and tax-free salary. Taxable salary must pay withholding income tax with rates varying according to the number of his/her dependents. Income tax withheld by company must be paid to the Tax Bureau before the 15th day of following month.

3. Each employee must have social insurance and pay housing fund. Computation is derived from “last year’s average monthly salary” as a basis in multiplying certain percentage. Chinese government authority will provide “last year’s average monthly salary” of earners every end of March. This base will be calculated from April to next March. Except when an employee bear his/her portion fees, employers have to undertake most of them. Payments shall be made to the Bureau of Labor Insurance, National Health Insurance Council and the Employee Pension Board before the 15th day of the following month.

How we collaborate with your subsidiary staff to do payroll processing job?

First, your staff will use Online Payroll Management System, designed by Evershine, to provide accurate information

1. Using Evershine system, your employees can fill in salary-related information, such as fixed salary, non-fixed salary, Leave data, Overtime data, “Last year’s average monthly salary”, Bank account information, E-mail Address, etc.

2. If you have your own human resource management system, you can provide us your monthly gross salary file for us to upload them in our salary management system.

Second, we use the Payroll Calculation Module to generate Monthly salary spreadsheet

1. 3 days before payday, in accordance with data files provided by your staff, we use Payroll Calculation Module to generate Monthly salary spreadsheet. It includes:

* Social Insurance Charge paid by the company and employee

* Housing Fund Charge paid by the company and employee

* Withholding Tax

* Gross salary and net-cash salary

2. Monthly salary spreadsheet must be approved by your authorized personnel staff.

3. After approval, file will be uploaded to your assigned bank for direct money wiring to each employee’s bank account.

Third, we present pay slip through different delivery routes in secure ways as below:

1. Individual pay slip delivery by email in .pdf format with encryption

2. We also allow each employee to check his/her own pay slip through cloud server.

3. Questions and clarifications are handled by our personnel over the phone.

Other Services

*Market Expansion services

*Market Research

*Trademark Application

*Domain Name (.cn) Application

*Due Diligence

Contact Us

If you are interested in any of the above-mentioned services, please send an email with your requirements to dxb2cn.east@evershinecpa.com Expect response within 2 working days.

Discuss with our representative in Shanghai for further information (GMT+08:00):

Shanghai Evershine BPO Service Corp.

Rm. 705 7F, Building B, No. 288 Hongjin Rd., Minhang Dist., Shanghai, PRC 201103

Located near MRT Line #10 LongPo New Village Station (地鐵10號線,龍柏新村站)

Tel No.: +86-21 -6402-0100

Email: dxb2cn.east@evershinecpa.com

For urgent concerns, please contact:

Manager Daniel Chen

Mobile: +86-184-1104-0929

Tel No.: +86-2-6402-0100

Fax: +86-2-6402-7267

For investment structure relevant with multi-national tax planning and Financial & Legal Due Diligence for M&A (Merge and Acquisition), send an email to HQ4dxb@evershinecpa.com & contact Dale Chen, Principal Partner/CPA in Taiwan+China+UK, AIA, & over-all responsible for these arrangements. linkedin address: Dale Chen Linkedin

Additional Information

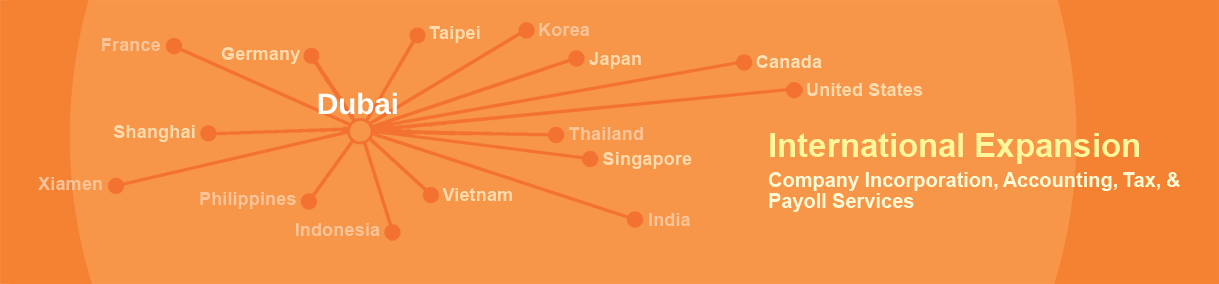

Evershine CPAs Firm has its 100% owned offices to provide services in different cities listed below:

Taipei, Beijing, Shanghai, Xiamen, Hangzhou

We have been providing our services with our co-service partners in different locations:

China Fukien: Fuzhou( 福州), Putian (莆田), Quanzhou(漳州), Changzhou(漳州), Pingtan (平潭);

China: Nanjing(南京), Guangzhou(廣州), Shenzhen(深圳), Dongguan(東莞) , Suzhou(蘇州), Kunshan (昆山), Tianjin (天津), Qingdao(青島)

Other locations:

Singapore, Hong Kong, Japan (Dubai), Korea (Seoul), India (New Delhi), Malaysia (Kuala Lumpur), USA (San Francisco CA)

We can arrange co-serving partners for other locations not mentioned above, please click the links to find out more: IAPA Members and LEA Members. There are many Evershine CPAs Firm assoicates around the world. We have around 980 firms with 38,000 employees in about 450 cities. If your firms are located in the above-mentioned cities, we can serve you right away.

Please contact us through HQ4dxb@evershinecpa.com

->>Other Cities in China

->>Shanghai Company Registration

–>>Shanghai WFOE Online Accountant Services

->>Shanghai Payroll Compliance dxb2cn.east Service